Opinion: Countdown to The U.S. — China Trade Standoff and Its Inevitable Fallout

In just a few weeks, the White House and the United States (U.S.) have found themselves in a situation from which escape will prove incredibly difficult. Starting on April 10, trade between the U.S. and China progressively — but irresistibly — came to a halt. Cargo bookings, in fact, collapsed in the wake of “Liberation Day.” It takes 30 days for a container to make the sea journey from China to Los Angeles, and 55 days to reach New York. Thus, it will be around May 10 that the economic effects will begin to be felt, and the trucking industry (a crucial and highly influential profession in the U.S.) will experience a standstill… due to a lack of goods to transport.

Warehouses and other storage facilities will have to proceed with layoffs, followed by the ports, with Los Angeles being the first to suffer. Chicago, Houston and New York will follow about two weeks later. This calamity cannot even be avoided in the most favorable (and least likely) scenario where tariffs are simply and entirely abandoned, because an additional 30 days would still be needed for U.S. economic activity to restart, first in Los Angeles, and a few weeks later in Chicago and New York.

Are my calculations and comments exaggerated? Let’s recall the lockdowns, when we learned the hard way that it takes an exceptionally long time for activity to return to normal. The U.S. finds itself like a passenger in a vehicle heading for a head-on collision that no one can avoid because it is now too late to brake. That is, of course, assuming that China and the United States resume their trade relations as if nothing had happened.

Between us, why would a country like China return to “business as usual” with a country that tried to strangle it? Just because it failed in the attempt? Knowing Americans well — and loving them — I nevertheless feel that they are neither intellectually nor materially prepared to be in the position of the attacked and the blamed, given what lies ahead.

Today, it is China that wants to reduce its relations with the United States. It is China that is de-dollarising. It is from China that the call for decoupling its economy is rising. By trying to take China “hostage” in this way, the United States has only accelerated these phenomena — phenomena that nearly all economists, analysts and politicians said would happen eventually… but much later. With a bonus for China: it will cost them much less to sever ties now at all these levels from the U.S., both financially and reputationally.

For the United States, the countdown has begun. Shortages are imminent, accompanied by factory closures caused by a shortage of spare parts and companies exhausting their orders. Even the defense sector will be impacted, discovering just how scarce some critical materials can be. The saddest part, however, will be the fate of small businesses — including some high-quality, well-known brands — that will go bankrupt this year because they will not have the ability to relocate outside of China.

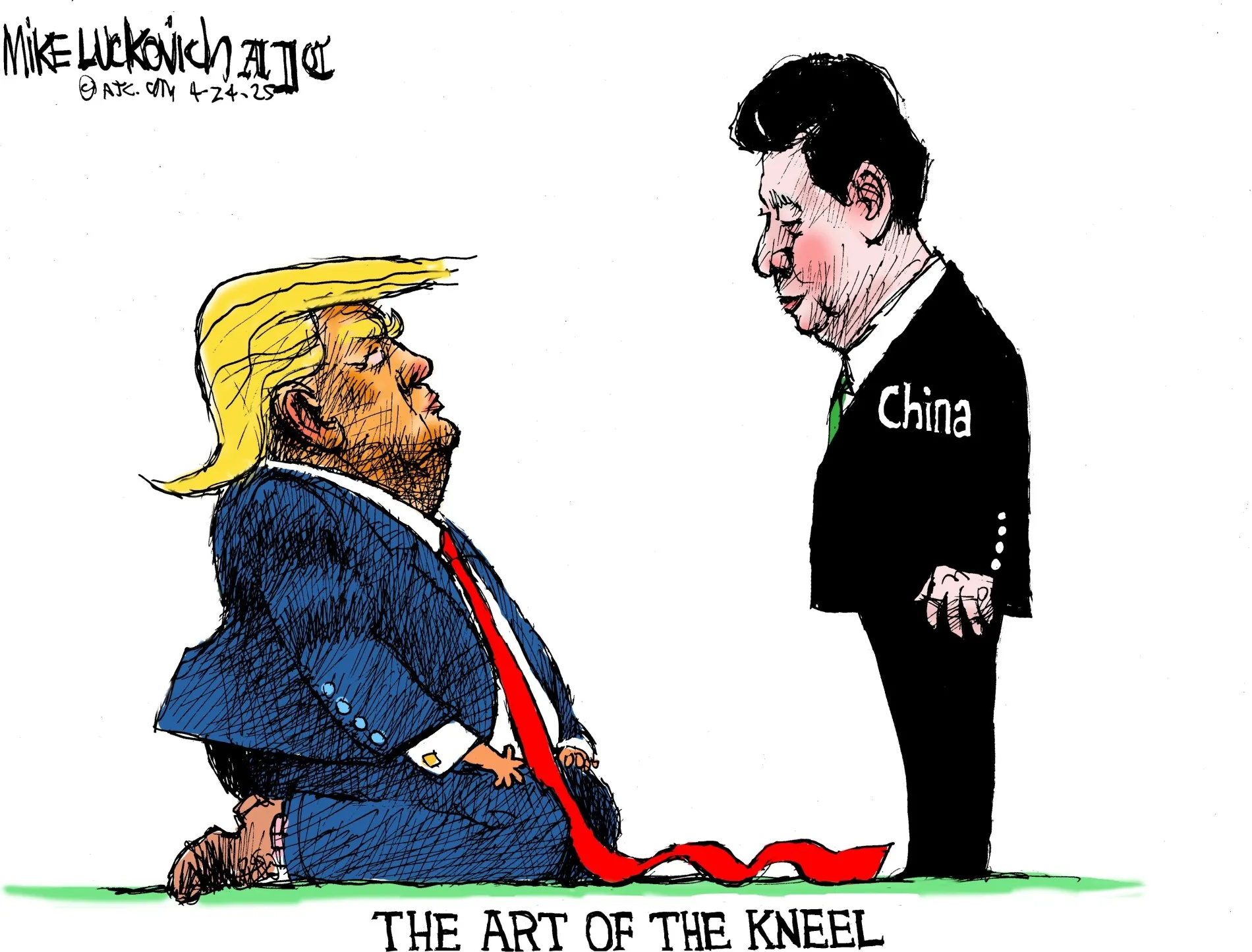

AI renderings depicting Chinese President Xi Jinping reading Donald Trump’s autobiography “The Art of the Deal“

Crushed by U.S. giants who will move operations to countries like Vietnam, these small and medium-sized businesses will be last in line — if they are served at all — by these new production chains, which will obviously prioritise American mega-corporations. These small and medium enterprises will likely be bought out by China, which will reap significant benefits by taking control of prestigious brands that took decades to build up their creative strength and market leadership.

This analysis needs no conclusion, as the author is stunned by what is coming.

This article was first seen on michelsanti.fr.

For more on the author, Michel Santi and his exclusive opinion pieces visit his website here: michelsanti.fr

For more on the latest in global economic and business reads, click here.

The post Opinion: Countdown to The U.S. — China Trade Standoff and Its Inevitable Fallout appeared first on LUXUO.