New Real Estate Investment Frontiers In 2026

As investors seek value, growth and diversification, the international luxury residential market is expected to migrate beyond the traditional powerhouses of New York, London and Miami by 2026. LUXUO investigates new economic corridors, regulatory reforms and growing wealthy populations, which are attracting money to sectors that were deemed peripheral. The eight countries listed below combine strong demographic trends, regulatory openness and attractive price dynamics to justify thoughtful consideration for cross-border property investors.

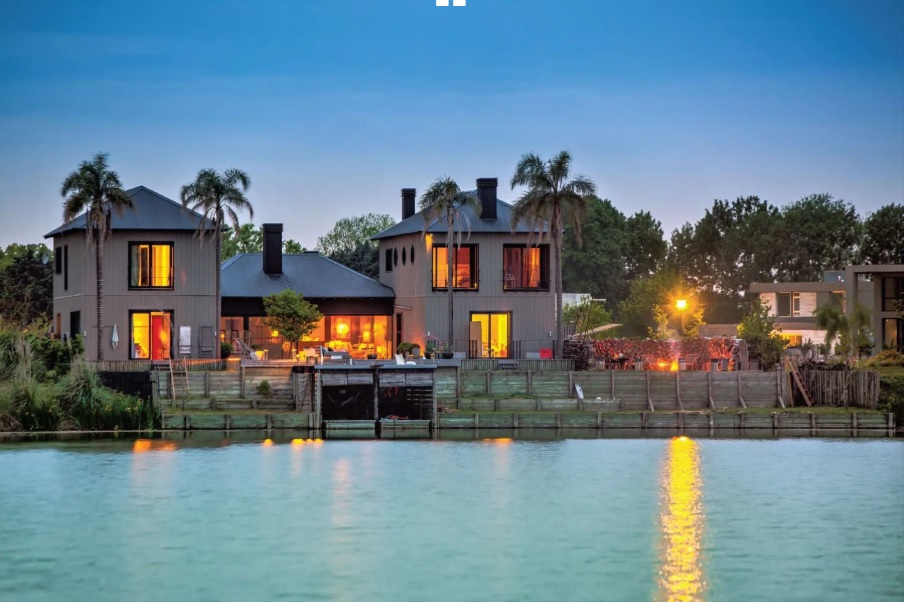

Portugal – Western Europe’s High-Growth Luxury Hub

In 2025, Portugal’s luxury home market outperformed those of Western European peers. According to Knight Frank’s Prime Global Cities Index, Lisbon placed among the top ten cities in the world for luxury price increase, with prices rising by approximately 5.3 percent year-on-year, exceeding Paris, London and New York. Savills forecasts that prime prices in Lisbon could increase 4 to 6 percent in 2025, maintaining momentum from the 6 percent growth seen the previous year.

In early 2025, national property prices increased by 15.2 percent year-on-year, the most in the EU and significantly higher than the Eurozone average of around 5 percent. In the Algarve’s premium market, transaction values topped EUR 75 million, with typical villa prices approaching EUR 5 million and ultra-prime estates much higher.

Investor composition is changing. Metrics from Portugal Sotheby’s International show 31 percent year-on-year revenue growth and a 34 percent increase in transaction volume, driven by increased demand from North America, Brazil and the United Kingdom, with average transaction values climbing significantly.

Domestic purchasers remain active, accounting for more than half of deals in 2025, while overseas capital increasingly focuses on branded houses and high-end seaside villas.

Lisbon and the Algarve are luxury hotspots, with average central prime prices exceeding EUR 6,100 per m² and limited availability, leading to increased demand. Portugal’s market combination of strong fundamentals, EU connectivity and lifestyle appeal continues to draw global mobile capital outside of conventional hubs.

Bulgaria – Eastern Europe’s Value-Driven Luxury Growth

Bulgaria’s luxury residential market in Sofia and select resort towns has emerged as a popular value option in the EU. According to a 2025 Christie’s International Real Estate study, sales of residences valued above EUR 600,000 increased by around 50 percent year-on-year, with 15 percent selling above the asking price, demonstrating significant buyer commitment at the upper end.

Bulgaria’s aggregate home prices increased by approximately 7.1 percent between late 2023 and 2024, making it the greatest gain in the EU during that period. Growth is expected to continue at a rate of around 15 percent in 2025. In Sofia’s premium class, typical costs are EUR 3,500 per m², with prominent core neighbourhoods surpassing this level.

Independent valuation data for late 2025 shows Sofia’s residential market reaching approximately EUR 2,310 per m², a 25.5 percent yearly rise, driven by record pricing in top areas and limited new supply. Premium city and beach properties have appreciated significantly over the last five years, with coastal resort values almost doubling and premium urban apartments increasing by 60 to 70 percent. Bulgaria’s high-net-worth demand is supported by cheap entry prices in comparison to Western Europe, friendlier tax regimes, lower borrowing costs and projected Eurozone entrance – a potential trigger for further value compression with Western markets.

Luxury clusters remain concentrated in Sofia’s Lozenets, Iztok and Izgrev districts, although seaside locations like Varna and Burgas provide price arbitrage and rental upside for investors seeking yield and diversification.

Vietnam – Southeast Asia’s Emerging Luxury Frontier

Vietnam’s luxury residential market continues to draw domestic and international investments as economic growth and urbanisation drive up demand in the country’s major cities. Prime apartment rates in Ho Chi Minh City and Hanoi now range from USD 5,400 to USD 15,000 per square metre, matching global gateway markets but below Singapore and Bangkok. This price stance has fuelled sustained capital inflows.

Government policy has simplified foreign ownership regulations and boosted investor access, while infrastructure developments, ranging from metro lines to international airports, are enhancing connectivity and property values. Foreign professionals relocating for multinational assignments create concentrated demand for luxury residences, which tightens supply, strengthens rental income and underpins sustained capital growth in urban and resort markets.

In Q3 2025, Hanoi had significant price hikes, with high-end apartments exceeding VND 180 million (approx. USD 6,840) per square metre in key districts and central luxury villa listings reaching VND 395 million (approx. USD 15,000). Branded apartments and premium buildings in Ho Chi Minh City have enjoyed considerable appreciation, with some sub-markets experiencing double-digit growth rates.

Vietnam’s luxury residential market is expected to reach over USD 3 billion in 2025 and nearly double by 2030, with a CAGR (Compound Annual Growth Rate) of 13 to 14 percent until the end of the decade. Despite their limited market share, villas and landed estates are one of the fastest-growing subsectors, with a predicted 14 percent+ growth rate.

Institutional and foreign capital flows are assisting this trend. Vietnam’s growing population of high-net-worth individuals (expected to reach 25,800 by 2025) is driving demand for branded luxury products. Infrastructure expenditures, like as new metro lines and road networks, are improving access to rising premium corridors.

Philippines – Manila Luxury Market Outpaces Regional Peers

Manila’s luxury residential sector is growing fast. According to Santos Knight Frank’s Prime worldwide Cities Index, prime home prices in Metro Manila rose 21.2 percent in a year, outperforming worldwide rivals such as Dubai (15.9 percent) and Shanghai (10.4 percent). Philippines News Agency Report cited Manila as one of the top five cities in the world for luxury price growth, with a 77.5 percent increase over five years, ahead of Los Angeles (56 percent) and Shanghai (32.8 percent).

Key nodes such as Makati, Bonifacio Global City and Manila Bay fetch high prices, with some central condos topping PHP 1 million per square metre in select launches. Macroeconomic fundamentals underpin demand: countrywide residential prices increased by around 7.5 to 8 percent per year through early 2025 and affluent domestic buyers, as well as foreign cash buyers who can acquire up to 40 percent of a condominium complex, put top stock under pressure.

While speculative categories suffer oversupply, luxury stock absorption remains strong in comparison to mid-market inventory. Luxury values are being driven by a restricted supply of ultra-prime properties, rising local wealth and important infrastructure improvements such as the LRT-1 extension. Manila not only outperforms regional counterparts, but it is frequently listed as one of the world’s fastest-appreciating luxury markets, with price trajectories substantially above global standards and a strong buyer base.

Saudi Arabia – New Ownership Rules Expand Investment Opportunity

Saudi Arabia’s residential sector is evolving from a primarily domestic play to a viable global frontier. In 2025, Riyadh’s residential prices increased by around 10.6 percent year-on-year, while overall residential transaction volume in the Kingdom increased in the mid-seven figures. In Jeddah, villa and apartment prices increased by 2 to 3 percent in the first half of 2025, with transaction values increasing by about 34 percent, indicating that demand is expanding outside capital pricing hotspots.

According to Knight Frank data, Riyadh apartment prices have climbed 75 percent in the last five years, while villa prices have increased by 39 percent, indicating long-term capital appreciation in major urban segments. In early 2025, the national average gross rental yield was approximately 6.75 percent, with Riyadh at 8.89 percent and Jeddah at 7.89 percent. These statistics are comparable to major global gateways. The foreign ownership system, which goes into effect in January 2026 and permits non-Saudis to buy defined residential properties outside restricted zones subject to registration and fees, represents a structural turning point for the country.

These amendments, combined with the Premium Residency programme, aim to increase international capital inflows by giving residency for real estate investments over SAR 4 million (approx. USD 1.07 million). Saudi Arabia’s domestic house ownership rate has climbed to approximately 63.7 percent, moving towards a government objective of 70 percent by 2030. However, price escalation and rent regulation, such as recent rent freezes, are reshaping affordability dynamics. The kingdom’s real estate is transitioning from a national home market to an open frontier, with rising prices, above-average returns and structural reforms that widen investor eligibility – an important narrative for 2026 allocation plans.

Taiwan – Selective Opportunity Amid Market Moderation

In 2025, Taiwan’s residential market has seen price deceleration and transaction declines, owing mostly to tighter mortgage regulations and lower buyer leverage. House prices in Tainan and Kaohsiung fell by around 2 to 5 percent year on year in Q3 2025, while overall transactions plummeted 28.1 percent compared to 2024, the lowest level since 2017. Taipei’s average gross yield is approximately 2.24 percent in mid-2025, indicating limited income possibilities for investors.

Luxury residential demand in Taiwan is concentrated in Taipei’s affluent neighbourhoods (such as Da’an), where premium pricing remains despite the overall market recession. High-net-worth purchasers who pay cash, notably those from China and regional buyers seeking asset diversification, continue to drive top-tier segments even as credit tightening inhibits speculative activity.

Long-term analysts predict that the Taiwan luxury residential sector would increase at a approximately 6.5 percent CAGR (Compound Annual Growth Rate) until 2033, with waterfront estates and penthouses dominating demand, indicating latent premium appeal despite the current downturn. Taiwan is a selective luxury play where premium micro-markets within Taipei and other global city pockets can outperform broader sentiment. Capital values are stabilising following cyclical contraction, establishing 2026 as a potential entry point for patient capital.

Taiwan is a selective luxury investment, with premium micro-markets in Taipei and other global metropolitan pockets potentially outperforming broader sentiment. Prices have cooled after several years of growth, creating clearer entry points for buyers focused on long-term value rather than short-term gains.

Argentina – A Market Repricing After Currency Volatility

Argentina’s residential market has recovered sharply in 2025, owing to currency fluctuations and financial restoration. Buenos Aires’ average costs range from USD 2,268 to 2,500 per m² citywide, with upscale enclaves like Puerto Madero fetching USD 5,931 to 6,500 per m². Sales volumes have increased by approximately 39 to 47 percent year-on-year, indicating increasing buyer interest after extended stagnation.

Prime neighbourhoods are experiencing a yearly nominal price rise of approximately 8 to 12 percent, whereas broader metropolitan markets have increased by 5 to 9 percent in recent cycles. Mortgage activity has increased by over 1,000 percent due to lower interest rates. This liquidity has increased participation and boosted turnover.

Medium-term predictions for Buenos Aires include ongoing annual growth of 7 to 10 percent in key districts through 2026 to 29, aided by peso depreciation, increased mortgage penetration and rising foreign buyer interest, particularly from dollar-linked investors seeking value relative to other global hubs. Luxury residential inventories are concentrated in established central nodes with outstanding rental and resale performance, whilst rising suburban submarkets show enormous appreciation potential. Gross yields in well-located apartments can surpass 7 to 9 percent, a unique characteristic among global gateway cities.

Puerto Rico – An American-Regulated Market With Strong Price Momentum

Puerto Rico’s real estate market is differentiated by a U.S. legal framework and tax-driven migration, resulting in strong price movement. Home prices increased by 11.6 percent in the first quarter of 2025, following a 22 percent increase in late 2024 — one of the highest recent quarterly growth rates observed outside of core U.S. metros. Luxury beach and resort homes in Condado, Dorado, Palmas del Mar and Bahía Beach command premium pricing and very fluid market absorption, contributing to the island’s total residential market valuation of USD 346 billion by 2025. Median selling prices have risen in recent cycles, reflecting both on-island demand and mainland U.S. investor inflows lured by tax breaks and lifestyle benefits.

Prime luxury pricing varies greatly – seaside estates can surpass USD 7 million and recent high-end listings exceeding USD 65 million have been recorded, indicating top-tier demand in the market. Rental returns, particularly in the short-term or high-tourism segments, can surpass 8 to 12 percent ROI, while longer-term leases in urban hubs such as San Juan continue to produce strong yields. Act 60 tax breaks (Puerto Rico Incentives Code, (Act No. 60-2019) — a comprehensive tax regime designed to attract investment and affluent residents by offering significant tax breaks to qualifying individuals and businesses), such as capital gains and income tax reductions for qualified residents, increase investor appeal. Puerto Rico combines U.S. regulation with Caribbean demand factors, resulting in a policy-supported pathway for luxury property that not only appreciates but also provides attractive income metrics and tax-efficient resident benefits.

Conclusion

For investors seeking alternatives to heritage hubs in 2026, these eight nations offer a wide range of value propositions, including rapidly rising Asian cities, regulatory opportunities in the Middle East, Europe’s value markets and frontier growth in Latin America. While risk profiles differ, the underlying drivers — economic expansion, demographic changes and greater cross-border accessibility — provide a solid foundation for informed investment decisions in the new year.

For more real estate reads, click here.

The post New Real Estate Investment Frontiers In 2026 appeared first on LUXUO.