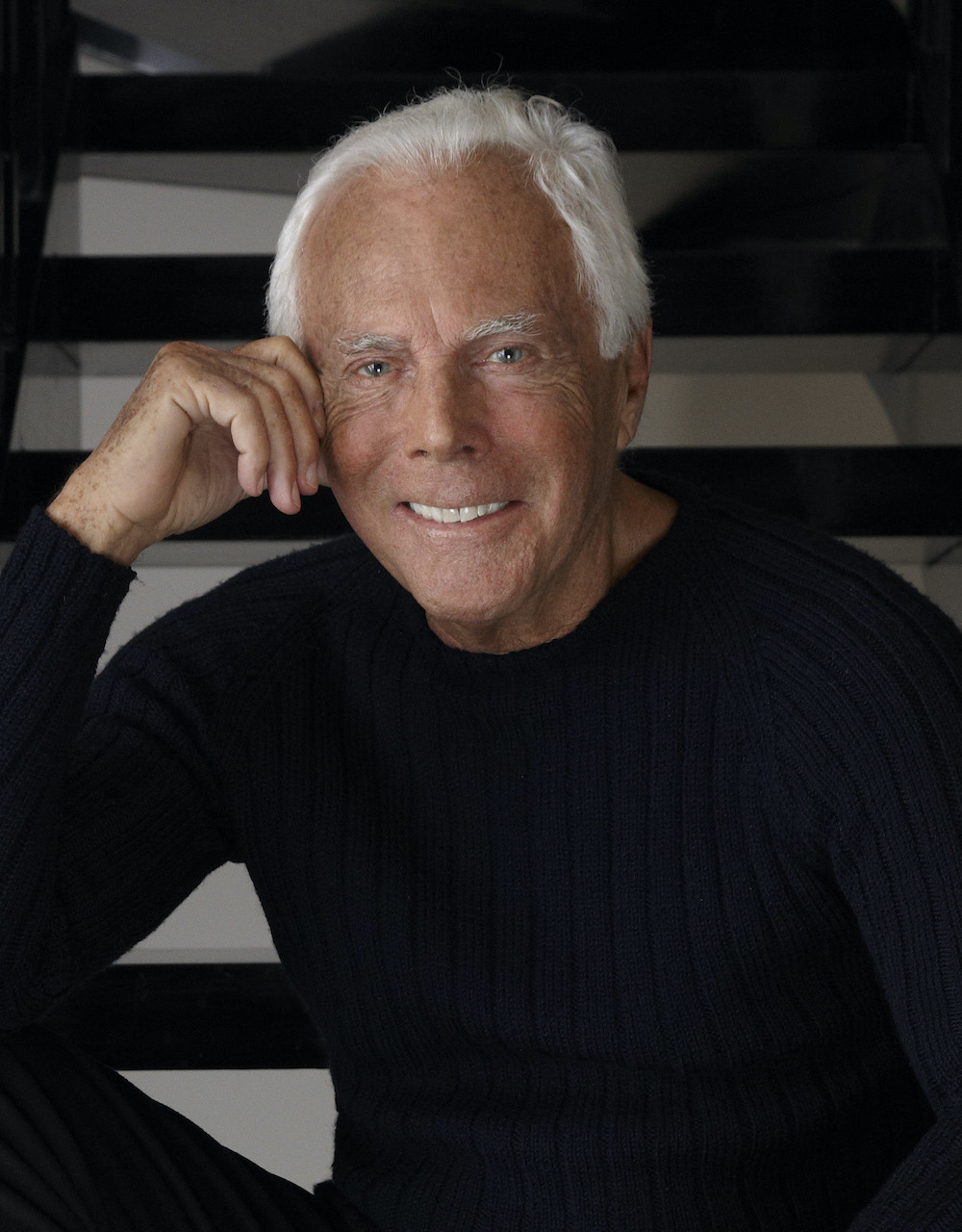

L’Oréal Tops the List in Armani Empire Succession Race

After Giorgio Armani’s death earlier this month, the late designer’s will laid out a rigorously staged exit strategy for the house he founded nearly fifty years ago. The plan involves partial stake sales, potential takeover by luxury conglomerates and possibly an IPO, while ensuring that the Armani legacy and identity remain protected. Preferred buyers named in the will include LVMH, EssilorLuxottica and L’Oréal. This is a major shift for a brand that was long defined by its independence.

Among the preferred buyers, L’Oréal appears best positioned to take the reins. Its long-standing partnership with Armani Beauty — a line that now generates more than USD 1.76 billion (approximately EUR 1.5 billion) annually — gives it not only financial leverage but also brand intimacy. Unlike EssilorLuxottica — whose strength lies in eyewear — or LVMH — which would fold Armani into a crowded stable of maisons — L’Oréal already functions as the face of Armani to millions of consumers worldwide. In this sense, the French beauty giant is not a distant suitor but a familiar “custodian” of sorts that could extend Armani’s vision into its next chapter.

L’Oréal’s potential acquisition of Armani would not be its first foray into steering a heritage name into the future. The French beauty giant has decades of experience in absorbing and scaling labels while successfully keeping their distinct DNA intact. When it took over Mugler’s beauty division in 2016, for example, L’Oréal successfully revived the fragrance arm with blockbuster launches like Alien Man and extensions of Angel, restoring the label’s profitability and cultural relevance. In 2023, Mugler’s fashion division was sold separately to Puig, underscoring how L’Oréal has long prioritised beauty and fragrance as its growth engines.

Similarly, L’Oréal has worked to carefully manage designer tie-ins, keeping names like Valentino, Yves Saint Laurent and Prada visible in the luxury fragrance market. By focusing on strong product pipelines, savvy celebrity campaigns and global distribution, the group has consistently translated prestige into scale. L’Oréal’s success lies in balancing brand heritage with commercial muscle — it rarely dilutes a label’s storytelling, instead magnifying its most bankable narratives.

A Legacy in Flux

In 2024, Armani’s fashion division reported revenues of approximately USD 2.70 billion (approximately EUR 2.3 billion), having declined by around five percent year-on-year. When beauty and eyewear licensing (managed by L’Oréal and EssilorLuxottica respectively) are factored in, the total value of the brand rises to USD 4.52 billion (EUR 4.25 billion). Revenue from licences plays a crucial role, with L’Oréal’s Armani beauty line generating about EUR 1.5 billion annually and eyewear contributing roughly EUR 500 million. Despite this, operating margins in the core fashion business have shrunk.

Read More: Giorgio Armani Dies at 91 Leaving Behind a USD 12.1 Billion Fashion Empire

As Giorgio Armani had no children, his will allocates control through the Giorgio Armani Foundation (set up in 2016) to his long-time partner Pantaleo “Leo” Dell’Orco and other family members. The Foundation holds at least 30.1 percent of capital, along with certain veto powers over major decisions. Dell’Orco is to receive 40 percent of voting rights. Other heirs include nieces Silvana Armani and Roberta Armani, and nephew Andrea Camerana, with some non-voting shares among them.

Armani’s will instructs that within 18 months of his death, heirs must sell an initial 15 percent stake in the company — with priority given to LVMH, L’Oréal or EssilorLuxottica or to a luxury group with which Armani has existing commercial ties. Within three to five years, the same buyer is expected to take a larger stake — between 30 and 54.9 percent. If no appropriate partner emerges, then an IPO should be pursued, preferably on the Milan stock exchange or another comparable market. The will emphasises that the Foundation must at all times retain at least 30.1 percent of capital to ensure the brand’s values are safeguarded.

Fit or Flaw

Like with any new structural ownership, challenges and risks can arise. The fact that Armani has named specific preferred buyers sharply focuses attention on how the brand might change under new ownership. LVMH brings scale, global infrastructure and expertise across many luxury categories, but integrating Armani’s creative style and preserving its signature aesthetic may prove challenging. EssilorLuxottica already handles Armani’s eyewear licence and thus has familiarity with part of the business, but the company’s core strengths lie in optics rather than full fashion houses. L’Oréal, meanwhile, has following and success in the beauty segment; its existing collaborations with Armani mean a level of trust, but a move into fashion operations would be a departure from its primary business model. Each potential buyer faces trade-offs between preserving heritage and unlocking scale.

Read More: Armani Group Achieves Continuous Growth Across 2022 and Q1 2023

An IPO alternative adds another layer of complexity. Public listing could raise capital, increase transparency and broaden ownership. But it also introduces pressure from shareholders, short-term performance expectations and risk to creative autonomy — risks that Armani has traditionally managed to avoid.

Past Precedent

The luxury industry has already demonstrated how beauty conglomerates can extend their reach into fashion. In 2022, Estée Lauder acquired Tom Ford in a deal valued at USD 2.80 billion, paying roughly USD 2.30 billion upfront and deferring USD 300 million until 2025. The acquisition gave Estée Lauder full control of the Tom Ford intellectual property, particularly its lucrative beauty and fragrance business while outsourcing ready-to-wear and eyewear through partners like Zegna and Marcolin. The move underlined how a cosmetics giant could secure a brand’s core assets while leaving fashion execution to licensees.

For Armani, the comparison puts L’Oréal in the strongest position. Already responsible for Giorgio Armani Beauty and fragrance, L’Oréal has proven it can integrate fashion-linked houses while keeping profitability in beauty at the centre. If Estée Lauder could absorb Tom Ford with limited fashion oversight, L’Oréal is even better placed: its longstanding licensing ties with Armani mean it already controls one of the brand’s most profitable divisions. That relationship — coupled with Armani’s own succession blueprint — makes L’Oréal the frontrunner in any takeover scenario.

READ MORE: Richemont Group Says No to an Acquisition by LVMH

The Future of Legacy Brands & The Luxury Industry

Central to Armani’s will is the guarantee that the Giorgio Armani Foundation will remain a guardian of brand identity. The Foundation must not hold less than 30.1 percent of capital and carries significant voting rights. The executive committee is charged with appointing a new CEO and ensuring the brand’s mission and design principles remain intact.

These measures suggest a determination to avoid what some critics describe as the “death of independence” that befalls many heritage brands after acquisition. Without such safeguards, branding, licensing and artistic direction are often subject to short-term profit pressures. Armani’s specifications for voting rights and gradual stake sale are designed to guard against this.

Read More: Giorgio Armani Cancels Runway Shows Amidst Rising Covid-19 Cases

In the short term, the first 15 percent sale to one of the named partners seems most likely. As it stands, L’Oréal is considered a strong candidate, given that it already shares licensing relationships and understands revenue streams under the brand. Over three to five years, that stake could rise or an IPO could become necessary if no preferred buyer meets the terms set by the will. Dell’Orco and the Foundation will retain enough influence to shape the brand’s future direction.

Consumers will be watching too. Luxury buyers increasingly care about authenticity, heritage and corporate transparency. A brand’s legacy is not just about design; the bigger picture involves who owns the brand, how it operates and whether it maintains its values under various fiscal and creative pressures. For legacy brands across luxury, the Armani succession plan represents a model that others will study closely.

Final Footnote

Giorgio Armani’s death marks a turning point not merely because one of fashion’s most independent leaders is gone, but because his exit plan lays bare the tensions between legacy and consolidation. Whether the brand remains a beacon of independent luxury or becomes another asset in a conglomerate portfolio now depends on structured stewardship, strategic partnership and unflinching adherence to the principles Armani set in motion.

Read More: LUXUO Looks Back: Giorgio Armani on his Pantelleria Holiday Home

For more on the latest in business reads, click here.

The post L’Oréal Tops the List in Armani Empire Succession Race appeared first on LUXUO.