Top 6 Mistakes New Traders Make When Starting with CFDs

The experience of trading can seem both exciting and confusing initially. New traders enter with lots of confidence but encounter unforeseen challenges. Understanding the most common mistakes may save one from unnecessary losses. Read on to obtain simple, actionable advice that enables you to trade wiser and less stressed.

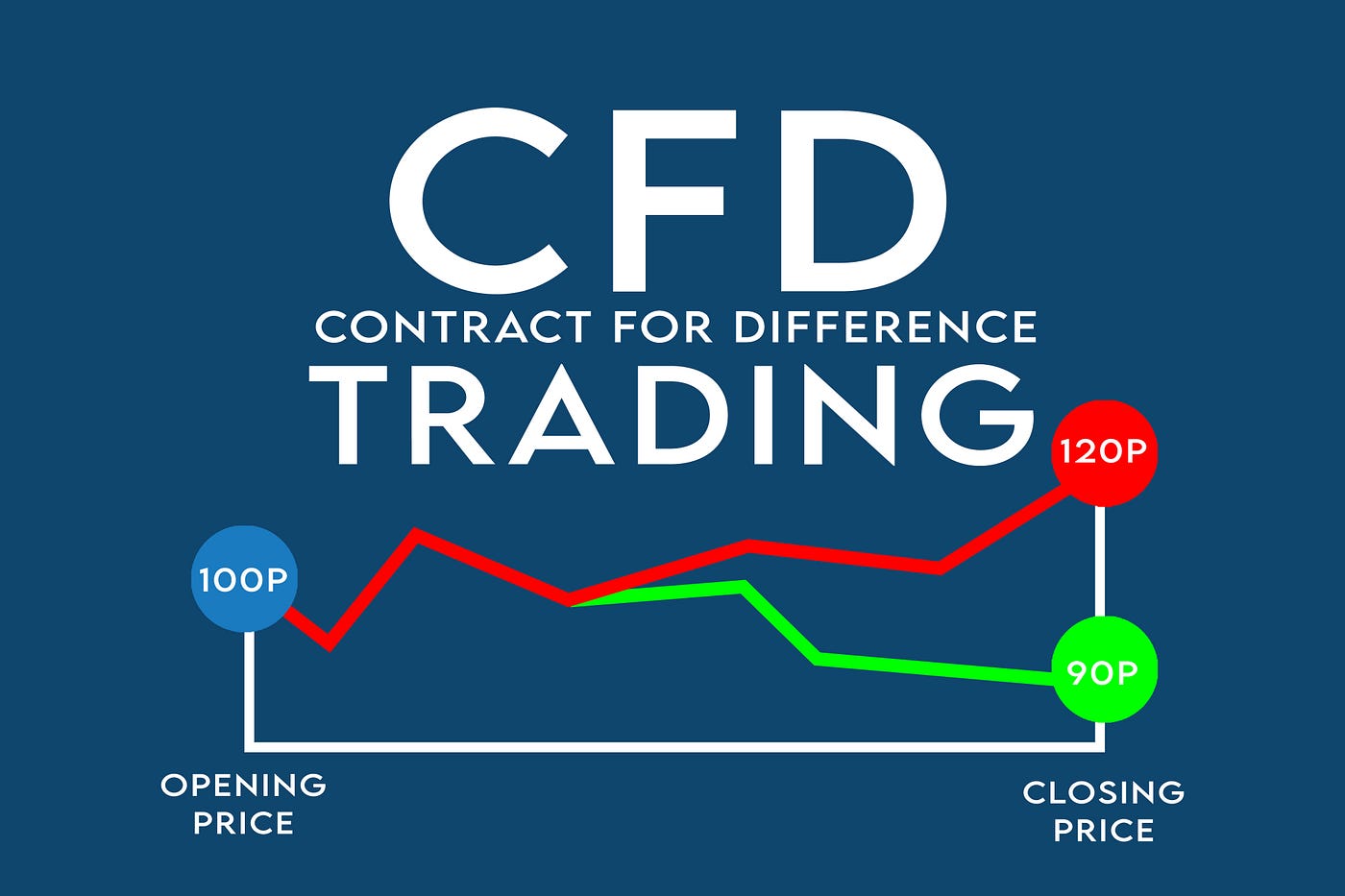

Many beginners rush into giao dịch cfd (cfd trading) without preparation. They focus on quick wins instead of steady progress. This approach creates tension and leads to costly decisions. Understanding what to avoid gives a clear path forward. Taking time to learn fundamentals sets a strong foundation. It allows traders to respond calmly to sudden market changes. Knowledge of tools and platforms makes execution smoother.

1. Unrealistic Profit Expectations

New traders usually start imagining big profits as soon as they start. They expect instant wins that rarely happen. Markets move gradually and rarely reward impulsive actions. Unrealistic goals bring frustration and poor choices. Setting achievable targets keeps focus and patience. Small gains build confidence over time. Tracking progress helps identify what works. Focusing on consistency creates long-term growth. Accepting small setbacks as part of learning keeps motivation high. Accepting small setbacks as part of the learning process keeps motivation high.

2. Essential Research Neglected

Market research gaps create blind spots. Some beginners trust tips from friends or follow headlines blindly. This can lead to avoidable mistakes. Learning charts, trends, and market behavior adds clarity. A little effort in research prevents major setbacks. Understanding the basics creates a stronger grasp of trades. Over time, research becomes a reliable habit that improves results. Using multiple sources increases the accuracy of insights. Documenting findings helps spot repeating patterns and opportunities.

3. Excessive Leverage Use

Leverage can make returns seem tempting. New traders often take positions too large for their accounts. High leverage magnifies losses quickly. Managing trade sizes protects capital and reduces stress. Starting with smaller positions teaches patience and control. Gradual experience with leverage builds confidence without unnecessary risk. Wise position sizing keeps trading sustainable. Learning how leverage works prevents surprise losses. Controlled exposure allows testing strategies to be used safely. Understanding the limits of leverage helps maintain consistent progress.

4. Absence of a Trading Plan

A trade without a plan is risky. A structured plan outlines entries, exits, and limits. It brings consistency in unpredictable markets. Following a plan improves discipline and decision-making. Beginners with a plan experience fewer regrets and better results. Adjusting the plan over time keeps strategies relevant. Planning first ensures each trade has purpose. A clear plan reduces second-guessing during volatile movements. Reviewing the plan after each trade sharpens future decisions. Sticking to a plan builds confidence and helps achieve steady progress.

5. Decisions Driven by Emotions

Emotions influence many beginners. Fear can cause hasty exits. Excitement might push trades that feel tempting. Keeping calm allows clear judgment and prevents mistakes. Simple techniques, like pausing before acting, help maintain control. Reviewing past trades builds awareness of emotional patterns. Calm, rational decisions create a stable trading approach. Recognizing triggers helps maintain consistency. Emotional control protects gains and limits losses. Developing a routine for reflection strengthens long-term discipline.

Avoid these mistakes to make trading less stressful for newcomers.. Clear goals, proper research, controlled leverage, a structured plan, and calm decision-making improve results. Beginners who apply these principles gain confidence quickly. Paying attention to these factors enhances giao dịch cfd (cfd trading) performance. Start small, stay patient, and focus on learning from each trade. Consistency and reflection help improve results steadily. Every step taken carefully builds stronger skills over time.

For more on the latest in business reads, click here.

The post Top 6 Mistakes New Traders Make When Starting with CFDs appeared first on LUXUO.