Luxury Brands Face a Reality Check in China

China’s luxury market is heading into 2026 in a period of cautious stabilisation following years of aggressive expansion and a sharp post-pandemic slowdown. Growth has shifted away from volume-driven strategies toward tighter pricing discipline, selective consumption and more deliberate brand engagement. Rather than opening stores at speed, brands are focusing on deeper penetration into rising cities, sharper segmentation and longer-term brand equity. Industry observers note that while the market has not returned to pre-pandemic growth rates, it is showing early signs of recovery. Analysts argue that the pace and sustainability of this rebound will depend heavily on consumer confidence and broader macroeconomic stability, rather than stimulus-led acceleration.

Focus on Rising Cities

Luxury brands are increasingly reallocating resources toward China’s so-called “rising” or lower-tier cities, where wealth accumulation continues even as top-tier consumption softens. Luxury brands have expanded store networks in tier-two and select tier-three cities such as Changsha, Wuhan, Chengdu and Xi’an, prioritising fewer but larger-format stores that anchor premium shopping malls rather than blanket expansion. A recent industry survey found that luxury brands opened 244 stores in China, with 169 in non-first-tier cities and 75 in first-tier markets, underscoring a shift toward broader geographic coverage.

Emergent markets such as Wuhan, Chengdu, Xi’an and Hangzhou are increasingly important nodes in China’s luxury network, with luxury stores making up a growing share of total store counts outside Beijing and Shanghai. In May, Miu Miu opened its first flagship store (spanning around 5,200 square feet and three stories) in Wuhan, located within the newly opened SKP Department Store. This is also seen with Coach which opened a flagship in Wuhan and Moncler which opened new stores in Nanjing, Jinan and Hefei demonstrating investment in non-tier-one markets and expansion outside the very top cities.

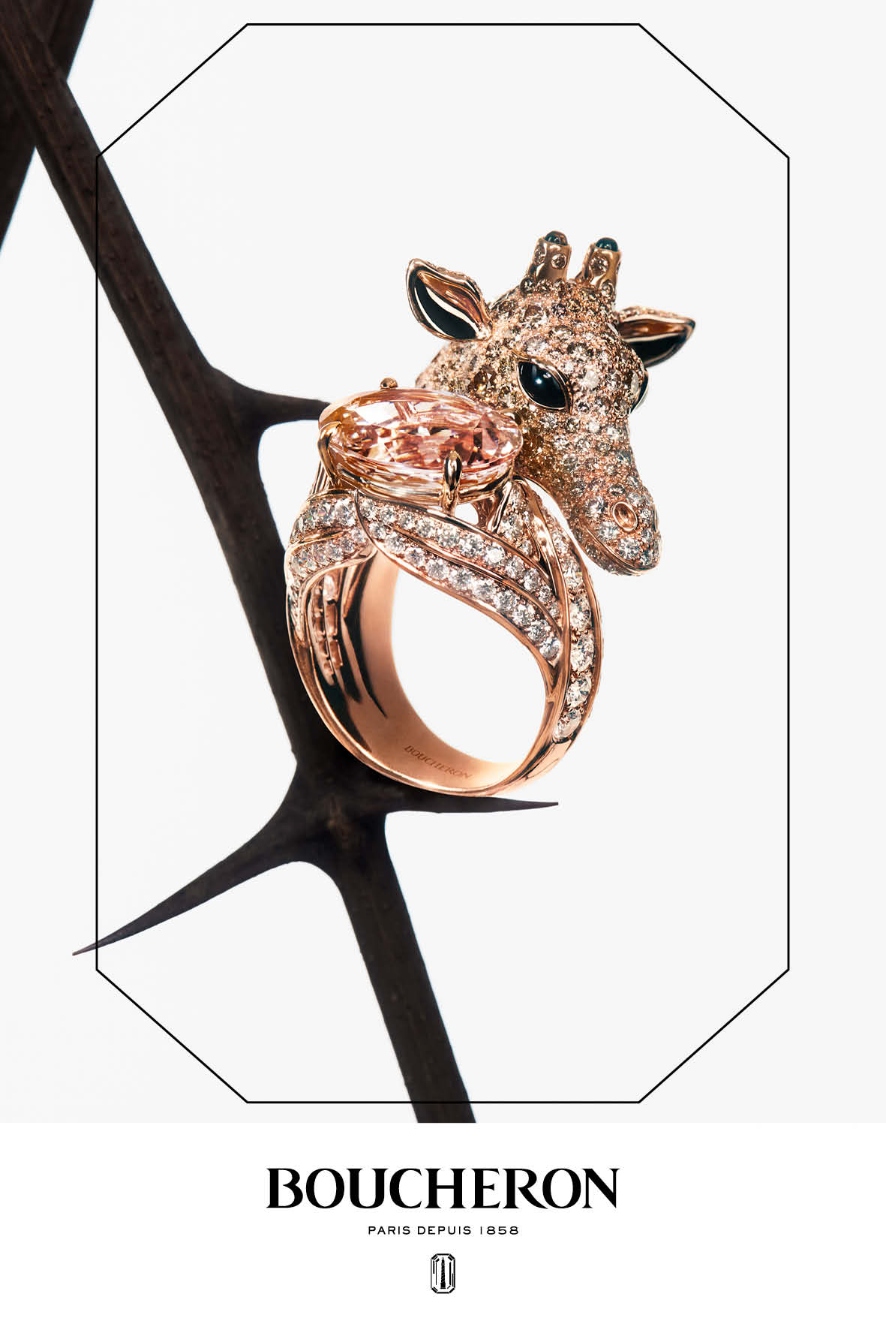

Rather than accelerating store openings in Beijing and Shanghai, brands are selectively deepening their presence in tier-two cities where consumption remains resilient and competition is less saturated. This could potentially see a trend of luxury jewellery Maisons like Cartier or Van Cleef & Arpels presenting high jewellery events in third-tier cities like Hangzhou or Suzhou as Richemont reported overall growth in luxury jewellery demand in Greater China

Valentino’s Haute Couture 2019 in Beijing

There is Luxury in Scarcity

Rather than pulling back entirely, Chinese consumers are becoming more selective. Spending is increasingly concentrated in categories and brands that deliver a combination of emotional resonance, cultural relevance and tangible value. This shift is forcing luxury houses to reassess product strategy, pricing architecture and engagement models, particularly as discretionary spending comes under pressure. This selectivity helps explain why certain segments are outperforming even as overall growth remains muted.

Rather than driving short-term volume through promotions or rapid rollout, brands are protecting pricing power and creative coherence to preserve brand equity. For example, Hermès continues to restrict supply in China, reinforcing scarcity and long-term brand strength rather than maximising near-term revenue. Valentino and Bottega Veneta have leaned into distinct creative identities — maximalism and craft-led minimalism, respectively — rather than chasing trend cycles tied to quick sales. Global luxury groups have scaled back aggressive discounting and price harmonisation in China, favouring tighter pricing discipline and fewer promotional cycles to safeguard brand perception — reinforcing the idea that scarcity is a defining marker of luxury.

Understanding Market Segmentation

This is reflected in how brands adapt to “market segmentation” by moving away from treating China as a single monolithic market and instead refining segmentation by age, spending behaviour and motivation. Chanel and Dior are investing in differentiated clienteling strategies, with private salons and invitation-only events aimed at high-spending VICs, while maintaining more controlled entry-level access for aspirational buyers.

Then, there are Prada and Loewe who have adjusted product mixes in China to reflect demand for expressive fashion and storytelling-led collections, rather than relying solely on globally standardised assortments (case in point being Lunar New Year releases). This sees luxury houses segment Chinese demand more finely — separating high-net-worth, investment-led consumers from younger or emotionally driven buyers — rather than chasing volume across the board.

@nkkoiiiiiii [Content for Qixi Festival from LOEWE] 2025.08.04

Micro-drama Episode 1

Caption : 第一集:她故意弄丢的喜鹊挂件,被谁捡到了? 拥抱多元的创意表达方式,是 LOEWE 罗意威的传统。2025年七夕佳节,LOEWE 罗意威推出七夕特别系列及原创剧集《鹊定爱》,致意这一以爱为主题的传统节日。 明晚7点,心动继续。 编剧:LOEWE 罗意威中国文化顾问秦雯 @不是秦雯 领衔主演:@陈都灵、@陈哲远- #ILOEWEYOU# (ตอนที่ 1: พวงกุญแจรูปนกกางเขนที่เธอตั้งใจทำหาย ถูกใครเก็บไปกันนะ? การโอบรับวิธีการแสดงออกที่หลากหลาย คือหนึ่งในเอกลักษณ์ของแบรนด์ LOEWE เสมอมา ในเทศกาลฉีซีปี 2025 นี้ LOEWE เปิดตัวคอลเลกชันพิเศษต้อนรับเทศกาลแห่งความรัก พร้อมซีรีส์ต้นฉบับเรื่อง “นกกางเขนที่ผูกชะตารัก” เพื่อส่งต่อความรู้สึกอันลึกซึ้งในเทศกาลอันเปี่ยมด้วยความรักนี้ คืนนี้ เวลา 1 ทุ่มตรง ความรู้สึกหวั่นไหวจะกลับมาอีกครั้ง บทโทรทัศน์: Qin Wen ที่ปรึกษาด้านวัฒนธรรมจีนของ LOEWE นำแสดงโดย: เฉินตูหลิง, เฉินเจ๋อหยวน ) #เฉินเจ๋อหย่วน #远远 #陳哲遠 #陈哲远 #chenzheyuan陳哲遠 #ChenZheyuan ♬ เสียงต้นฉบับ – KoiNK

CZY – KOILoveCZY

China Informs (Not Follows) Trends

Luxury marketing in China has recently seen an explosive growth in short-form drama content. China’s micro-drama audience is expected to reach 696 million users in 2025, with platforms such as Xiaohongshu and Tmall integrating narrative content directly into commerce. Rather than relying solely on celebrity endorsements, luxury brands are experimenting with original micro-dramas as a way to build emotional engagement and shorten the path to purchase. This is seen with Loewe who unveiled an original five-episode micro-drama dubbed “Say Yes to Love” as part of the release of the 2025 Chinese Valentine‘s Day collection inspired by traditional Qixi legend imagery. This marks a shift toward more frequent, story-led touchpoints that align with evolving content consumption habits.

Furthermore, domestic brands that already understand the nuances of the market are gaining ground as Chinese labels like Laopu Gold and Songmont have seen rapid market share increases, challenging European houses and drawing strategic attention from groups like LVMH — whose leaders are increasingly engaging with local designers.

Gold is a Girl’s Best Friend

Gold jewellery has gained renewed strategic importance as Chinese consumers increasingly view it as both a cultural symbol and an investment asset — particularly amid the rising value of gold. Domestic brands rooted in traditional craftsmanship — including Laopu Gold and Baolan — have seen surging demand to cater to it. The momentum has drawn strategic attention from global luxury groups such as LVMH and Kering, underscoring a broader recalibration of luxury value in China toward material worth.

Perhaps indirectly (or directly) related to this is the research that shows that women aged 45 to 59 have emerged as one of China’s most influential luxury consumer groups, controlling an estimated RMB 10 trillion in annual spending. This demographic is known to place priority on long-term relevance over novelty or trend-driven consumption.

China’s luxury market is absorbing economic pressure by prioritising selective spending over volume growth. Growth now depends on alignment with domestic values and selective consumer confidence — a reality check that is forcing luxury brands to rethink how fast they grow and why consumers should choose them at all.

For more on the latest in business and luxury industry reads, click here.

The post Luxury Brands Face a Reality Check in China appeared first on LUXUO.