L’Officiel’s Chinese Takeover Unravels Into a Global Legal Battle

Once hailed as a financial lifeline for a struggling publishing house, the 2022 acquisition of Éditions Jalou by Chinese financial group AMTD is now at the centre of a legal and criminal investigation that could threaten the future of one of fashion’s luxury titles.

French authorities have confirmed that an investigation into suspected large-scale fraud is underway following a complaint lodged by the Jalou family, founders of the publishing house behind L’Officiel. The complaint was formally filed on 5 March 2025 and the case has been assigned to the financial investigations unit of the Paris judicial police. What began as a corporate rescue has since evolved into a multi-jurisdictional dispute spanning Europe, Asia and offshore financial centres.

At the heart of the legal action is the allegation that AMTD Group — alongside its subsidiaries including AMTD Digital and The Generation Essentials Group — prioritised financial engineering over responsible stewardship. The Jalou family is seeking at least EUR 40 million in damages to creditors and accuses the group of stripping assets from the century-old fashion institution while it remained under court supervision.

From Rescue to Receivership Fallout

Founded in 1921, Éditions Jalou was long regarded as a cornerstone of French fashion publishing, overseeing titles such as “L’Officiel de la mode”, “Jalouse” and “L’Optimum”. The group also previously owned “The Art Newspaper” — another internationally influential cultural title — before both assets were sold to AMTD. Its decline began in the mid-2010s following a costly legal dispute in Russia, culminating in the company being placed into receivership in 2022.

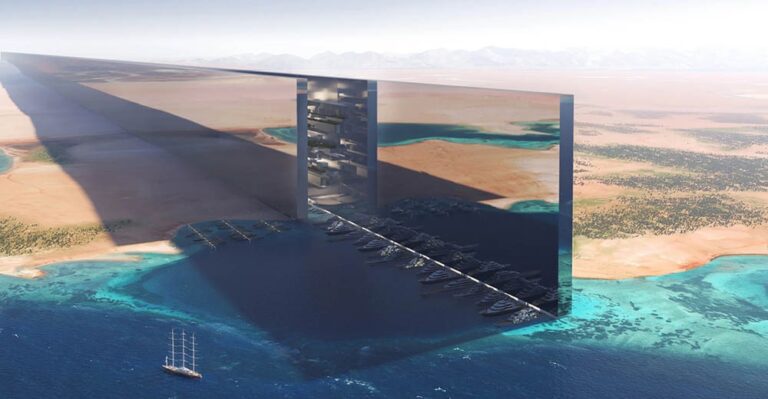

AMTD — a Hong Kong-based conglomerate with a diverse portfolio spanning across digital solutions, media, entertainment and hospitality — presented itself as something of a “white knight” capable of stabilising the business. The acquisition was accompanied by high-profile gestures designed to signal revival, including a special edition unveiled at the World Economic Forum in Davos and a fashion show staged at the New York Stock Exchange. However behind the spectacle, the relationship between buyer and seller was already fraying. According to legal filings reviewed by French authorities, the Jalou family alleges that the takeover masked a “predatory” operation aimed at hollowing out the French entity rather than rebuilding it.

Allegations of Fraud, Trademark Abuse and Missing Assets

The complaint accuses AMTD of counterfeiting, tax fraud, trademark infringement and misuse of company assets. Central to the case are claims that a series of opaque financial structures spanning Paris, New York, Hong Kong, the Cayman Islands and the British Virgin Islands were used to divert value away from Éditions Jalou.

One key allegation concerns the unlawful registration of the “L’Officiel” trademark in around 40 countries through a foreign subsidiary based in the British Virgin Islands, despite the recovery plan explicitly prohibiting any transfer or disposal of the brand. The family further alleges that licensing agreements were terminated and reassigned to overseas entities, depriving the French publisher of revenue while expanding AMTD’s control abroad.

Among the most alarming accusations is the disappearance of L’Officiel’s photographic archives, a unique visual record documenting more than a century of French fashion and culture. The family maintains that the whereabouts of these archives remain unknown. The Jalou family also claims that proceeds from the sale of the business were never fully paid. They allege that AMTD failed to settle the full purchase price for both “L’Officiel” and “The Art Newspaper,” while portions of the funds that were due remain frozen within AMTD-controlled accounts.

At the same time, they argue that AMTD exploited the L’Officiel brand across international markets — notably in Asia and the Middle East where the magazine maintains a wide publishing footprint — without revenue flowing back to the French entity. International licensees were reportedly instructed to bypass Éditions Jalou altogether and deal directly with the new owners, effectively severing the original company from its most valuable asset.

Tax Claims and Regulatory Scrutiny

Another pillar of the case concerns alleged tax evasion. The Jalou family accuses AMTD of seizing control of the L’Officiel brand — which they value at nearly EUR 85 million — as part of a scheme designed to avoid French tax obligations. They argue that these actions directly contravened the court-approved recovery plan established when the company entered receivership. That plan — which runs until 2028 — explicitly restricts the transfer or sale of assets and trademarks in order to protect employees, suppliers, URSSAF and the French state.

According to the complaint, AMTD committed “serious and repeated violations” of these conditions, undermining the very framework that allowed the acquisition to proceed. Marie-José Jalou — the magazine’s former editor-in-chief and one of its most prominent figures — has described the situation as devastating. “L’Officiel was the bible of fashion,” she said. “It cannot be treated as a speculative asset. I will never give up.”

The dispute has also expanded beyond France. Despite ongoing legal proceedings, AMTD has listed both “L’Officiel” and “The Art Newspaper” as media assets on the London and New York stock exchanges, a move that has further inflamed tensions between the parties. The group’s founder — Chinese financier Calvin Choi — is now directly named in several of the disputes.

The case unfolds against a broader backdrop of scrutiny surrounding AMTD, which has faced separate regulatory issues and legal proceedings involving the Hong Kong Securities and Futures Commission. For the Jalou family’s legal team, the issue extends beyond a commercial disagreement. “L’Officiel is a century-old French fashion institution,” their lawyers, Céline Bekerman and Antoine Cadeo, said. “Its heritage must be preserved and cannot be sacrificed for predatory practices.”

As investigators work through a web of cross-border transactions, disputed trademark registrations and unpaid proceeds, the future of “L’Officiel” remains uncertain. What began as a rescue operation has evolved into a cautionary tale about the risks facing heritage media brands in an era of global capital. Regardless of the outcome, the case underscores a broader tension in a globalised market, where fashion and cultural institutions risk being subordinated to financial engineering rather than protected as heritage assets.

AMTD Pushes Back with Defamation Lawsuit

In January 2026, AMTD Group and its subsidiaries announced that they had launched legal proceedings against Benjamin Eymere — a member of the Jalou family and former employee of an AMTD subsidiary, alleging malicious falsehood, defamation and misconduct. The group claims Eymere was dismissed for mismanagement, that subsequent appeals in the Paris courts were dismissed and that his recent actions prompted AMTD to involve law enforcement. AMTD also rejected what it described as inaccuracies circulating in press and social media, stating that its 2022 acquisition of L’Officiel was fully completed with 100 percent of the purchase price paid, that the controlling seller was investment group GEM rather than the Jalou family and that L’Officiel has not incurred new debt since the takeover. The company said it would continue to pursue legal action to defend its reputation, positioning itself as a lawful owner acting to counter allegations made by the magazine’s founding family.

For more on the latest in business and finance reads, click here.

The post L’Officiel’s Chinese Takeover Unravels Into a Global Legal Battle appeared first on LUXUO.

(@nyse)

(@nyse)